Research Areas

Mental Model of the Market - The Market Manthan Engine

Our Trading Analytics and Strategies rely on research done under our proprietary MarketManthan Engine, which analyzes various patterns in the market to build a mental model of the market action with entire market data.

This mental model Engine leverages our proprietary:

Market Wave Analytics

QuantaMetrics

SentiMetrics

Price Valume Analytics

Fundametrics

Research Components

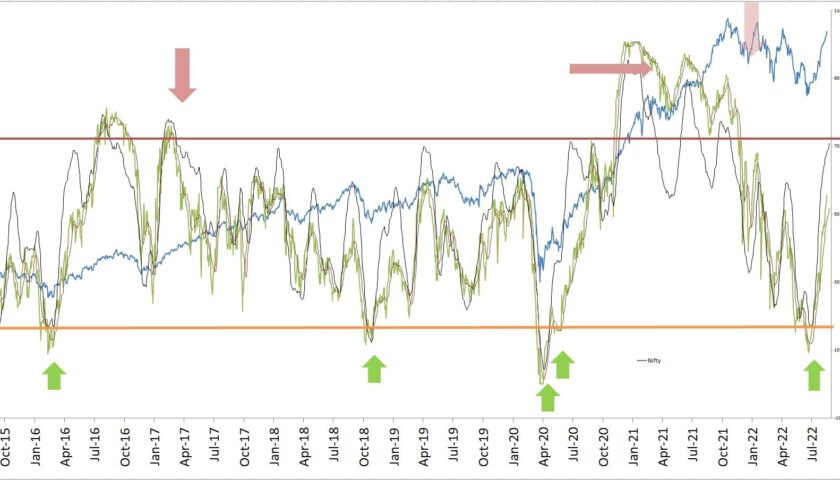

Market Wave Analytics

Breadth Profiling, Broad Spectrum Profiling

Deep & detailed quantitative analysis using Market Breadth methods and crunching Orthogonal Macro Technical Indicators. Leverages both Mean Reversion and Momentum studies. Our Market Wave Studies also leverage our Proprietary QuantaMetrics & SentiMetrics to assess market situation and potential trends.

2. QuantaMetrics

Quantitative Analytics

Our MarketManthan Engine Quantitatively analyzes Price Action, Volume Action, Technicals, Open Interests, and many such quantified factors to accordingly generate our signals, recommendations and portfolio weights. It uses both on End Of Day and Intra-day market data, to build suitable trading signals and strategies.

3. SentiMetrics

Sentiment Analysis

Our MarketManthan Engine Quantitatively analyzes Price Action, Volume Action, Technicals, Open Interests, and many such quantified factors to accordingly generate our signals, recommendations and portfolio weights. It uses both on End Of Day and Intra-day market data, to build suitable trading signals and strategies.

4. Price Volume Metrics

Price Change, Volume Change, Volume BuildUp, ...

Quantitified Analysis using:

Price Volume Ratings

Price Volume Delta Ratings

Price Relative Strength Ratings

5. FundaMetrics

Fundamentals and Financials

Quantitified Analysis and screening of Fundamentals and Financials of key companies listed on NSE, to access various valuation ratios, valuation quality metrics like EV/EBITDA, EVA growth, PEG, PB, Dividend ratios, to shortlist high quality, high probability candidates for investing and positional portfolios.

Market Manthan Engine

The Market Manthan Engine, combines inputs from all of the above Engines. It further runs various market data monitors across a range of stocks, futures and options. The Analytics runs on data across various time-frames to assess how various stocks and their derivatives are being acted upon by market players and how are they moving on their price action. Generates high probability signals and opportunities.

Market Manthan is a comprehensive Market Analytics Engine, both on End Of Day and Intra-day market data. It builds high probability signals to leverage across trading strategies. On market data, it analyzes Price Action, Volume Action, Technicals, Open Interests, and many such quantified factors to accordingly generate signals, recommendations and portfolio weights.

Market Manthan Engine : Key components

1. Intraday data signals

Generates Intraday Signals based on Quantitative, technical and market behaviour analytics

2. EOD data signals

Generates signals based on quantitative, technical and Various Orthogonal factors that drive markets in medium to long term.

3. MacroTechnical Engine

Combines Market Cyclical studies, market macros, fund flow, and various factors that drive 2 common behaviour in the market i.e. momemtum and mean reversion.

4. Quantitative Analytics

Generates signals based on key levels to generate high reward / risk signals, with defined risk and high probability of large return.

_